The Long run Effect of Balance of Payments on the Gross Domestic Product of Kenya

Charles Ombuki,

Department of Economics, Machakos University

Abstract

The study intended to investigate the long run effect of balance of payments on the Gross Domestic Product (GDP) of Kenya. The study was necessary since there is no other study of the same that has ever been done in Kenya given the fact that the country suffers from a deficit in her balance of payments in most of the years. While using time series data from 19991 to 2016, causal type of research design was employed and a multiple regression model was run using eviews statistical software. Ordinary Least Squares method was used to estimate the model. Other variables that were used as control variables include exchange rate, exports and imports. It was found out that in the long run, there is a significant and negative effect of balance of payments on the gross domestic product of Kenya. Imports were also found to have a significant effect on gross domestic product in the long run even though the effect is positive. Other variables, that is, exchange rate and exports were found to have a positive effect on gross domestic product of Kenya in the Long run even though the effect is not significant. It was recommended that the central bank devalue Kenyan currency to an optimal level so as to increase its exchange rate and in the long run make its exports cheap. This will lead to a surplus in its balance of payments and increase the GDP.

Key words: Gross Domestic Product and Balance of Payments.

Introduction

The extent to which Balance of Payments influences gross domestic product in the long run is a central theme in many theoretical traditions that are critical to mainstream economics. For instance there is no agreement between the Keynesian and Structural models on whether the supply side factors cause economic growth in the long term (Cimoli and Porcile, 2014). They also do not agree that economic agents are rational agents who can make their own decisions that have factored in the current economic situation. According to Lima et al., (2008), a significant role is played by aggregate demand in the determination of the long run economic growth since potential output accumulations are all demand–determined. This being the case, Lima et al. (2008) asserts that the demand-oriented approach for the Keynesian emphasizes that growth is influenced by external factors same as growth influenced by balance of payments.

Balance of Payments of a country is a systematic record of all economic transactions that have occurred between residents of that country and residents of the foreign country during a given period of time (Mohr, 1998). It consists of three main components, namely; current account, capital account and financial account. On the other hand Gross Domestic Product (GDP) is the total value of all finished goods and services produced within the geographic boundaries of a country in a particular period usually one year (Mohr,1998). GDP can be measured using income approach (adding all income stemming from production of the year’s output such as compensation of employees, indirect taxes, interest and wages), expenditure approach (adding up all the spending on the final goods and services) or the value added approach (adding total revenue and subtracting total cost of intermediate goods).

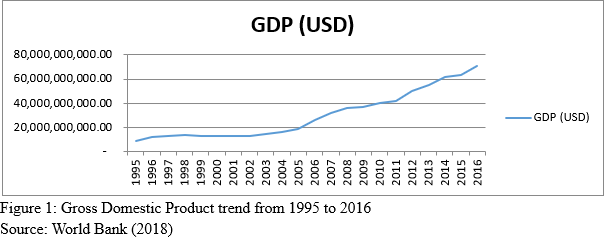

In Kenya, the GDP trend has been varying as shown in Figure 1:

Kenya has been showing an increasing trend in GDP since 1995 to 2016. For instance in 1995 the total GDP was $9.046 billion, in 1996 the GDP was $12.046. The GDP increased from $13.11 billion in 1997 to $14.09 billion in 1998 but decreased to $13.14 billion in 2002. Come 2004, the gross domestic product was at $16.095 billion, $40 billion in 2010, $55.097 billion in 2013 and it has continued to increase all through to 2016 where Kenya recorded a GDP of $70.53 billion. This is attributed to increased production in Agriculture which is the back born of the country’s economy as well as improvement in the manufacturing, service and tourism sectors.

On the other hand, Kenya’s Balance of Payments trend has also been varying as shown in Figure 2.

Kenya has been experiencing a deficit in its Balance of Payments in most of the years from 1995 to 2016. In 1995 and 1996,Kenya had a BoP deficit of $1,236 million and$693 million in 1996 respectively. The deficit increased from $1,670 million in 1997 to $2982 million in 1998, it decreased to $408 billion in 2001 and in 2002 Kenya recorded a surplus in its Bop of $106. Come 2004 the BoP was again a deficit of $42 million, in 2010 the deficit increased to $4,082 million, $9,518 million in 2013 and the situation has continued to be the same all through to 2016 where Kenya also recorded a BoP deficit of $7,456 million. This is attributed to a continued deficit in Kenya’s financial and current accounts. These deficits in the current and finance accounts are as a result of Kenya exports whose value is less than the value of imports. Even though Kenya registers a surplus in its capital account in most of the years, this is not enough to allow Kenya have a surplus in its overall balance.

From the above analysis, it is evident that Kenya’s Gross Domestic Product continues to increase despite the fact that it suffers from Balance of Payment deficit in most of the years. On the same note since Keynesian and Structural models are not in agreement on whether supply side factors causes growth in an economy, this study therefore intended to examine the effect of Balance of Payments on the economic growth of Kenya since balance of payments accommodates both supply and demand side factors. It is also a point to note that most of the studies that have been done on economic growth and balance of payments focus on balance of payments constrained growth and there is none which has ever been done in Kenya. This study therefore was necessary in Kenya and it aimed to find out the Long Run effect of balance of payments on the gross domestic product so as to fill the gap that has been in existence for long.

Other independent variables captured by the study included exports, imports and exchange rate since they also influence economic growth rate of any country.

Literature Review

Thirlwall’s growth model

Economic growth in the long run is determined by the Harrod Foreign Trade Multiplier which is dynamic according to Thirlwall’s growth model. The model emphasizes that it is the demand factors that stimulates growth in the economy. Balance of Payments is the demand’s dominant constraint in any unclosed economy. The main idea of the approach of Thirlwasll is to show how an economy’s growth performance is influenced by the balance of payments. The model connects trade to economic growth since exports tend to pull demand more than any other factor. In case there are problems associated with balance of payments, trade represents only one major constraint as far as economic growth is concerned. That is not a major concern since other growth models like those of Grossman and Helpman (1992) also leave out constraints of balance of payments and focus only on trade and economic growth.

The Structuralists and Keynesians schools of thought confirm that there exist both supply and demand constraints in an unclosed economy. On the same note the approach of Thirlwall emphasizes that performance in economic growth can not be realized only through export promotion, financial liberalization or trade. Both capital and current accounts are taken into account by the Structuralists and Keynesians schools of thought and therefore it is advisable to not only consider export of goods and services but also income elasticity associated with import demand.

From Thirlwall (1979) model, its three equations namely; export demand function, import demand function and current account equilibrium can be represented as follows in equations 1, 2 and 3 respectively:

Empirical Review

An, P. S. (2007) did a study focusing on the question whether the balance of payments of Vietnam constrained its economic growth for a period between 1990 and 2004 used the model which was developed by Thirlwall. Using quarterly data as well as annual data from that given period, it was found out that economic growth was constrained by the balance of payments of the country. This happened despite the fact that there were deficits in both the trade and current account that were to some extent relieved by capital’s external inflows like foreign direct investment, debt and official development assistance. The study therefore recommended the government of Vietnam to come up with policies that relieves balance of payments so as to stimulate growth in the economy.

A study by Felipe, J. et al. (2010) was conducted in Pakistan to find out how the economic growth of Pakistan is constrained by its BoP. It is evident that the maximum economic growth rate for Pakistan that is consistent with the equilibrium is about 5 percent per year. Comparing with the growth rate target in the long run, this rate is far below the target that ranges between 7 and 8 percent per year. It is also evident that this constrained economy growth rate approach of balance of payments also provides significant implications for the development policy of Pakistan. An improvement in the current account cannot be improved by depreciations of the real exchange rate. It is recommended that Pakistan has to lift those constraints that necessitate export growth. Specifically it has to shift the structure of exports towards products of higher income demand elasticity.

Rieber, A. et al. (2016) also did a study in Vietnam using data of between 1985 and 2010. A multi-country model of balance of payments constrained growth was used and it was found out that in the entire period considered, Vietnam’s economic growth grew at a rate less than that given in the model with the exception of a certain period between 1998 and 2010. It was also found out that the effect of relative price is neutral and this allowed effects of the volume to dominate while setting the constraint of the balance of payments. Economic growth in developed countries is made to have a multiplier effect in the economy of Vietnam by exports’ high income elasticity. The effect is interrupted by a huge volume of imports that come to the country from Asia.

Lélis, M. T. C. et al. (2017) carried out a study in Brazil to analyze the balance of payments constrained economic growth. Two models were used to estimate both import and export demand functions. These two models that were used include structural state space model and vector error correction model. The study employed data covering the period between 1995 and 2013. It was found out that in Brazil, the balance of payments is a constraint to its growth since exports seem to be sensitive to changes in prices of commodities than to real exchange rate changes. The outcome is also possible since there is also low exports sensitivity to real exchange rate changes.

Methodology

The causal type of research of research design was used in this study since with this type of a research design it is possible to identify the cause and effect variables. There are many variables that affect economic growth but in this study, exchange rate, imports and exports were used in addition to balance of payments as the control variables. Ordinary least squares method of estimation was used since all the OLS assumptions were satisfied. Time series data was used covering the periods from 1991 to 2016.

Before the data was put into use, various tests were carried out on data of the variables to find out whether the results to be realized were viable. Diagnostic tests that were carried out include Augmented Dickey-Fuller (ADF) tests which was based on Schwarz Info Criterion (SIC) to test series stability, Descriptive statistics to test variable volatility, Wald test to test independent variables’ significance as a group, normality test with the help of Jarque- Bera statistic, Breusch-Pagan-Godfrey test to test for heteroscedasticity, Ramsey Reset Test to test for specification errors, Chow Forecast Test to test coefficients’ structural change, and Recursive Coefficient Estimates for variable stability test. The study assumed that the relationship between dependent and independent variables was linear.

Long run model was specified as follows:

The constant also referred to as the y-intercept gives the level of economic growth when all the other independent variables equals to zero. The coefficients measure the change in economic growth when a given independent variable changes by a unit while all other independent variables are kept constant. For example measures the change in gross domestic product in the long run when balance of payments growth rate changes by a unit given that exchange rate, exports and imports are kept constant.

The study targeted the Kenyan population from 1991 to 2016 since this is the period the data used in the study covered. Ordinary Least Squares method was used to estimate the model since all OLS assumptions were satisfied. Central bank was the source of data where the secondary data sheet was used to collect data. The data was modified to suit the model used in the study and finally analyzed using the eviews statistical software.

Presentation and Analysis of Results

This section presents the results of the study whose objective was to examine the long run effect of balance of payments on the gross domestic product of Kenya. Other control variables that were used in the study include exchange rate, exports and imports. Various diagnostic tests have also been captured in this section.

Descriptive statistics

Table 1: Descriptive Statistics Summary

|

|

GDP |

BOP |

EX |

X |

M |

|

Mean |

2.67*10^10 |

-2.33*10^11 |

68.06 |

5.71*10^9 |

7.92*10^9 |

|

Median |

1.55*10^10 |

-2.07*10^11 |

73.83 |

4.28*10^9 |

4.38*10^9 |

|

Max |

7.05*10^10 |

-7.42*10^9 |

98.18 |

1.12*10^9 |

2.03*10^9 |

|

Min |

5.75*10^9 |

-5.48*10^11 |

22.91 |

2.15*10^9 |

1.95*10^9 |

|

Std Deviation |

1.99*10^10 |

1.45*10^11 |

18.82 |

3.10*10^9 |

6.00*10^9 |

|

Skewness |

0.8547 |

-0.3403 |

-0.9353 |

0.6784 |

0.8273 |

|

Kurtosis |

2.3886 |

2.1289 |

3.3388 |

1.9948 |

2.1719 |

|

Jarque-Bera |

3.5707 |

1.3240 |

3.9150 |

3.0892 |

3.7088 |

|

Probability |

0.1677 |

0.5158 |

0.1412 |

0.2134 |

0.1565 |

|

Sum |

6.93*10^11 |

-6.06*10^12 |

1769.55 |

1.48*10^11 |

2.06*10^11 |

|

Sum square dev |

9.95*10^21 |

5.23*10^23 |

8851.48 |

2.4*10^20 |

9.0*10^20 |

|

Observations |

26 |

26 |

26 |

26 |

26 |

Table 1 presents various descriptive statistics of variables that were used in the study. It includes the mean, median, maximum value, minimum value, standard deviation, skewness, kurtosis, Jarque-Bera test, probability and sum square deviation of the study variables. The total number of observations that were used was 26. It is also evident from the table that GDP has a mean of 2.67*10^10 US dollars but the average balance of payment is -2.33*10^11 US dollars, meaning that Kenya experiences a deficit in its balance of payment every year. The GDP’s maximum value is 7.05*10^10 US dollars and minimum value is 5.75*10^9 US dollars with a median and standard deviation of 1.55*10^10 US dollars and 1.99*10^10 US dollars respectively. The respective values for balance of payments are -7.42*10^9 US dollars, -5.48*10^11 US dollars, -2.07*10^11 US dollars and 1.45*10^11 US dollars. Other variables’ descriptive are as shown in the Table 1 above.

Granger Causality Tests

Granger causality test was run so as to show the direction of the relationship that exists between different variables that were used in the study. The test tests the null hypothesis that one of the variable does not granger cause another variable. This hypothesis is not accepted if the P-value for the effect of one of the variables on any other variable is not more than 5 percent. It is evident from Table 2 below that the null hypotheses that one of the said variables granger causes not another variable cannot be rejected since the P-value is more than 5 percent.

Table 2: Granger Causality Tests Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: |

Obs |

F-Statistic |

Prob. |

|

|

|

|

|

|

|

|

|

|

|

BOP Granger Causes not GDP |

24 |

0.15911 |

0.8540 |

|

GDP Granger Causes not BOP |

0.06843 |

0.9341 |

|

|

|

|

|

|

|

|

|

|

|

|

EX Granger Causes not GDP |

24 |

1.22926 |

0.3147 |

|

GDP Granger Causes not EX |

16.4906 |

7.E-05 |

|

|

|

|

|

|

|

|

|

|

|

|

X Granger Causes not GDP |

24 |

2.82889 |

0.0841 |

|

GDP Granger Causes not X |

4.29313 |

0.0289 |

|

|

|

|

|

|

|

|

|

|

|

|

M Granger Causes not GDP |

24 |

1.81814 |

0.1895 |

|

GDP Granger Causes not M |

7.39163 |

0.0042 |

|

|

|

|

|

|

|

|

|

|

|

|

EX Granger Causes not BOP |

24 |

0.43798 |

0.6517 |

|

BOP Granger Causes not EX |

0.70695 |

0.5057 |

|

|

|

|

|

|

|

|

|

|

|

|

X Granger Causes not BOP |

24 |

1.15201 |

0.3371 |

|

BOP Granger Causes not X |

0.21396 |

0.8093 |

|

|

|

|

|

|

|

|

|

|

|

|

M Granger Causes not BOP |

24 |

0.09318 |

0.9114 |

|

BOP Granger Causes not M |

0.31995 |

0.7300 |

|

|

|

|

|

|

|

|

|

|

|

|

X Granger Causes not EX |

24 |

1.95094 |

0.1696 |

|

EX Granger Causes not X |

0.05065 |

0.9507 |

|

|

|

|

|

|

|

|

|

|

|

|

M Granger Causes not EX |

24 |

2.24541 |

0.1332 |

|

EX Granger Causes not M |

0.60676 |

0.5553 |

|

|

|

|

|

|

|

|

|

|

|

|

M Granger Causes not X |

24 |

1.26629 |

0.3046 |

|

X Granger Causes not M |

0.96875 |

0.3975 |

|

|

|

|

|

|

|

|

|

|

|

Correlation Tests

The dependent variable in this study was gross domestic product and the independent variables include; balance of payments, exchange rate, exports and imports. Correlation test is done to find out whether these variables correlate with each other.

Table 3: Correlation Matrix

|

|

GDP |

BOP |

EX |

X |

M |

|

GDP |

1.00 |

0.14 |

0.72 |

0.97 |

0.98 |

|

BOP |

0.14 |

1.00 |

-0.21 |

0.25 |

0.22 |

|

XM |

0.72 |

-0.21 |

1.00 |

0.69 |

0.69 |

|

X |

0.97 |

0.25 |

0.69 |

1.00 |

0.98 |

|

M |

0.98 |

0.22 |

0.69 |

0.98 |

1.00 |

It is evident from Table 3 above that there is no perfect correlation between two different variables. It is only the relationship between balance of payments and exchange that is found to be negative but for the rest of other variables it is positive.

Wald Test

Wald test is carried out to show whether the independent variables are significant in the study. If the variables are found to be significant, then their parameters are not zero and therefore need to be included in the model.

Table 4: Wald Test Summary

|

Test statistic |

Value |

Df |

Probability |

|

F-statistic |

609.0126 |

(5,21) |

0.0000 |

|

Chi-square |

3045.063 |

5 |

0.0000 |

Table 4 shows that the F-statistic probability and the Chi-square probability are all less than one percent. This means that all the independent variables that were used in the study are significant and therefore have to be included in the model.

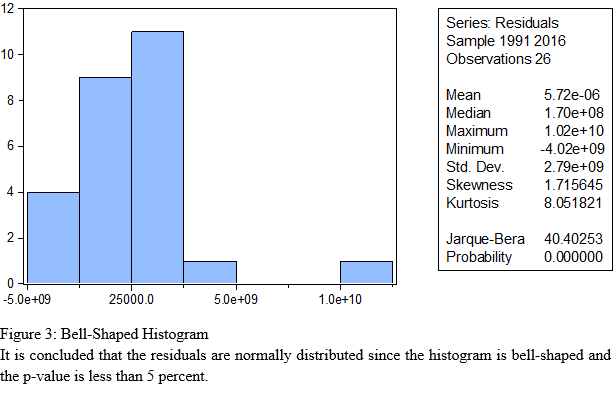

Normality tests

Normality test is another diagnostic test that was carried out to so as to show whether there is normal distribution of the residuals. For the residuals to be normally distributed, the histogram has to be bell shaped and the p-value less than 5 percent.

Heteroscedasticity: Breusch-Pagan-Godfrey Test.

Breusch-Pagan-Godfrey Test was used to test for heteroscedasticity. This test intends to find out whether error terms’ variance that exists in the regression function is constant. There is no heteroscedasticity if the p-value is more than 5 percent.

Table 5: Heteroscedasticity Test Summary

|

F- Statistic |

1.7861 |

Probability. F(4,21) |

0.1694 |

|

Obs*R-squared |

6.6000 |

Probability. Chi-Square(4) |

0.1586 |

|

Scaled explained SS |

15.1813 |

Probability. Chi-Square(4) |

0.0043 |

Table 5 shows that there is no Heteroscedasticity since the p-value is more than 5 percent.

Chow forecast test

This test assesses the stability of the coefficients in a regression model which is multiple in nature. The data is split into break points and in this study the break point was introduced in the year 2000. In simple terms the test is used to test whether there are structural changes in the model. If p-value is less than 5 percent, the null hypothesis that there is no structural change is rejected but accepted if more than 5 percent.

Table 6: Chow Forecast Test Summary

|

|

Value |

df |

Probability |

|

F-statistic |

14.3422 |

17,4 |

0.3183 |

|

Likelihood ratio |

107.2864 |

17 |

0.0000 |

Table 6 shows that there is no structural change in the model since the p-value is more than 5 percent

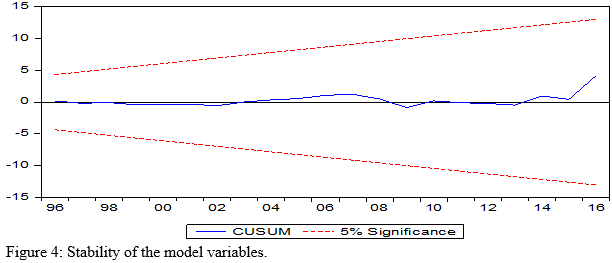

Recursive coefficient estimates test

To test whether the variables used in the model are stable, recursive coefficient estimate test is used to test for the same.

If the blue line lies between the two red lines, then the variables are stable. It is evident from Figure 4 that the variables used in the model are stable since the blue line lies between the two red lines.

Stationarity Tests

Augmented Dickey-Fuller tests with the selection of the lag based on Schwarz Info Criterion was used to carry out unit root tests for the variables. All variables showed the presence of a unit root and since all variables as indicated in Table 7 had a p-value of less than 5 percent and t-statistic of more than two in absolute terms, then all of the variables were stationary.

Table 7: Stationarity Test Summary

|

Variable |

t-statistic |

Probability |

|

GDP |

2.9144 |

0.0093 |

|

BOP |

2.5602 |

0.0172 |

|

EX |

-4.7622 |

0.0001 |

|

X |

-4.3427 |

0.0002 |

|

M |

-3.6377 |

0.0014 |

Multiple Regression Results

The multiple regression model was run using eviews statistical software and the results are as shown in Table 8, hence realizing the objective of this study which was to determine the long run effect of balance of payments on the economic growth of Kenya.

Table 8: Multiple Regression Results Summary

|

Variable |

Coefficient |

Standard Error |

t-statistic |

Probability |

|

BOB |

-0.011547 |

0.005362 |

-2.153347 |

0.0431 |

|

EX |

2918601 |

55017200 |

0.053049 |

0.9582 |

|

X |

0.942796 |

1.127542 |

0.836151 |

0.4125 |

|

M |

2.857491 |

0.550893 |

5.187015 |

0.0000 |

|

Constant |

-4.25*10^09 |

2.94*10^09 |

-1.443518 |

0.1636 |

Table 8 presents the coefficients of the independent variables namely; balance of payments, exchange rate, exports and imports. The value of the constant is also given. The standard deviation, t-statistic and probability of the respective variables are equally provided. The p-value for balance of payment and imports is less than 5 percent and their respective t-statistic is more than 2 in absolute terms. In the case for exchange rate and exports, the p-value is more than 5 percent and the t-statistic is less than two in absolute terms. The same applies to the constant value. This implies that the balance of payments and imports coefficients are statistically significant while those for exchange rate and exports are statistically insignificant.

In case balance of payments changes by a unit, gross domestic product changes by -0.011547

units if all other variables are kept constant, that is, while holding all other variables constant, an increase by one unit in the balance of payments causes a decrease of 0.011547 units in the gross domestic product. On the same note, while holding all other variables constant, increase by one unit in imports causes an increase of 2.857491 units in the gross domestic product. Increase of one unit in exchange rate and exports leads to an increase of 2918601 and 0.942796 units in gross domestic product respectively if all other variables are kept constant. Since these coefficients for exchange rate and exports are insignificant, there change is also taken to be insignificant. In case all other variables equals to zero, the gross domestic product decreases by -4.25*10^09 units. It is also worth noting that 97.67 percent of the changes in the independent variables is explained by the dependent variable (gross domestic product) since adjusted r-squared is 0.976712.

Summary, Conclusion and Policy Implications

This study intended to examine the long run effect of balance of payments on the gross domestic product of Kenya. Other control variables such as exchange rate, exports and imports were used alongside the balance of payments. From the analysis it is evident that in the long run, the effect of balance of payments on the gross domestic product is statistically significant and negative. This is because Kenya always experiences a deficit in its balance of payments. Any increase in this deficit calls for an increase in borrowing and this in the long run accumulates more interests which have to be repaid together with the principal amount. Less is therefore left for investment thus leading to a decrease in gross domestic product. The effect of imports also causes a significant and positive effect on the gross domestic product in the long run. This implies that the Kenyan imports are more valuable than exports since when well invested, in the long run they fetch more returns. It also implies that it is cheap for Kenya to import some materials other than producing them in the country. In the long run, the effect of exports and imports on the gross domestic product is not significant since most of the Kenyan exports are primary products that does not yield more returns as does the secondary products like machinery.

It is therefore concluded and recommended that for Kenya to improve its gross domestic product in the long run, it has to invest more on secondary products so as to increase the value of the exports. This will lead to a surplus in its balance of payment and in the long run increase its gross domestic product. It is also recommended that for Kenya to enhance growth in its gross domestic product, goods that are produced in the country expensively should be imported. Since increase in exchange rate leads to an increase in gross domestic product, is therefore advisable for central bank to consider devaluing Kenya’s currency to an optimal level so as to make exports cheap and in the long run increase the gross domestic product.

References

An, P. S. (2007). Economic growth and balance of payments constraint in Vietnam. Vietnam Economic Management Review, 1, 51-65.

Cimoli and Porcile, 2014 M. Cimoli, G. PorcileTechnology, structural change and BOP-constrained growth: a structuralist toolbox Camb. J. Econ., 38 (1) (2014), pp. 15-237

Coenen, G., Mohr, M., & Straub, R. (2008). Fiscal consolidation in the euro area: Long-run benefits and short-run costs. Economic Modelling, 25(5), 912-932.

Felipe, J., McCombie, J. S., & Naqvi, K. (2010). Is Pakistan’s growth rate balance-of-payments constrained? Policies and implications for development and growth. Oxford Development Studies, 38(4), 477-496.

Grossman, G. and Helpman, E.E. (1992), “Comparative advantage and long-run growth”, America Economic Review, Vol. 80, pp. 19 – 64.

Lélis, M. T. C., da Silveira, E. M. C., Cunha, A. M., & Haines, A. E. F. (2017). Economic growth and balance-of-payments constraint in Brazil: An analysis of the 1995–2013 period. EconomiA.

Rieber, A., Bagnai, A., & Dao, T. T. A. (2016). Economic growth and balance of payments constraint in Vietnam.

Thirlwall, 1979 A.P. Thirlwall The balance of payments constraint as an explanation of international growth rates differences Banca Nazionale del Lavoro Quarterly Review, 128 (1979), pp. 45-53

World Bank (2018). World Bank Data

Download The Long run Effect of Balance of Payments on the Gross Domestic Product of Kenya